Getting A Geico Quote - A Simple Guide

Thinking about insurance can feel like a big job, but getting a Geico quote does not have to be a complicated thing. Lots of people look for ways to save money on their car coverage, and sometimes, that means checking out what different companies offer. Maybe you are just curious, or perhaps you are really trying to find a better deal for your current setup. Either way, understanding the steps can make the whole process feel much easier, you know?

It's a bit like when you are trying to gather up all the bits of information you need for something important. You might find yourself wondering, "Where do I even begin?" Well, with Geico, they have made it pretty straightforward to get a price for your coverage. You do not need to be a whiz at complicated computer programs or anything like that. It is more about having a few key pieces of information ready, and then just following some simple prompts, more or less.

This guide is here to walk you through what to expect when you go to get a price from Geico. We will look at what kind of details you might want to have on hand, the different ways you can go about asking for a quote, and what comes next after you get one. It is really about making the experience as smooth as possible for you, so you can quickly see what your options are, as a matter of fact.

- Did Frank Fritz From American Pickers Pass Away Unraveling The Truth

- Frank Fritz How Did He Die

- The Fascinating World Of Memory Understanding How We Remember

- Understanding Kehlanis Age A Comprehensive Insight Into The Life Of The Rising Star

- Dhruv Age Exploring The Rising Stars Journey And Achievements

Table of Contents

- Why Get a Geico Quote?

- What You Need Before You Start to get a geico quote

- How Do You Get a Geico Quote Online?

- Other Ways to get a geico quote

- What Happens After You Get a Geico Quote?

- Are There Ways to Save Money on a Geico Quote?

- Common Hiccups When You try to get a geico quote

- Can I Change My Mind After I get a geico quote?

Why Get a Geico Quote?

You might be asking yourself, "Why should I even bother to get a Geico quote?" That is a really fair question, and there are quite a few good reasons people choose to look into what Geico has to offer. For some, it is simply about making sure they are getting a good deal on their car insurance. Prices can shift, you see, and what was a good rate last year might not be the best one this year, you know?

Then there are folks who are buying a new car, or maybe they are adding a young driver to their policy. When big life changes happen like that, it is a smart move to check out new insurance options. Geico is pretty well known for its rates, and so a lot of people like to compare what they are currently paying with what Geico could offer them, just a little.

Some people are also just curious about what is out there. They might be happy with their current insurance, but they still want to keep an eye on the market. It is a bit like doing some research before you buy something big; you want to know all your choices, right? Getting a quote from Geico is a quick way to get that information, without any pressure to buy anything, basically.

- Is Kurt Russell Alive The Truth Behind The Rumors

- Livvy Dunne Naked Leaks A Comprehensive Exploration Of The Controversy

- Nina Aouilk Parents A Deep Dive Into Her Family Background

- Frank Fritz Obit Remembering A Beloved Reality Tv Star

- Exploring Www5movierulz Your Ultimate Guide To Streaming Movies Online

It is also a way to see if you are missing out on any possible savings. Sometimes, companies have special discounts you might not even know about, and getting a new quote can bring those to light. It is really about being informed and making the best decision for your own situation, in a way.

What You Need Before You Start to get a geico quote

Before you even begin the process to get a Geico quote, having a few pieces of information ready can make things go much smoother. Think of it like gathering all your tools before you start a project. You would not want to be halfway through and realize you are missing something important, would you? So, having these details handy means you can move through the steps without stopping, pretty much.

First off, you will want some details about yourself. This includes your full name, your birth date, and your current address. Geico, like any insurance company, uses this to figure out who you are and where you live, which helps them give you a price. Your driving history also plays a part, so they will ask about any accidents or tickets you have had in the past few years, as a matter of fact.

Then, you will need information about the vehicle or vehicles you want to insure. This means the year, make, and model of your car. You will also need the Vehicle Identification Number, or VIN, which is a unique code for your car. It is usually found on your dashboard or on the driver's side door jamb. Knowing this helps Geico get the exact specifications of your car, which is important for the quote, you know.

If there are other drivers in your household who will be covered, you will need their names and birth dates too. This is because everyone who drives the car affects the insurance price. So, it is not just about you, but about anyone else who might get behind the wheel, in some respects.

Having your current insurance policy information can also be helpful, even if you are just looking. It gives Geico a good idea of your current coverage levels, which can make it easier to compare apples to apples. You do not have to have it, but it can speed things up, really.

Think of it like trying to count the number of times something appears on a list; if you already have some of the counts, you just add to them. Similarly, if you have these details ready, the system can quickly figure out what you need, and then you just confirm it, or something like that. It saves you time in the long run, and you get your price faster, typically.

How Do You Get a Geico Quote Online?

Getting a Geico quote online is, for many people, the quickest and easiest way to do it. It is pretty much set up to be a straightforward process that you can do from your computer or even your phone, you know? You just go to their website, and right there on the main page, you will see a spot to start your quote. It is very, very clear where to click to begin, basically.

Once you click to start, you will be asked to put in some of those details we just talked about. It usually begins with your zip code, as that helps them figure out the rates in your area. Then, it will ask about your vehicle and about you, the driver. The forms are pretty simple to fill out, with clear questions asking for specific pieces of information, so.

As you go through the steps, the system will ask about your driving history, any past accidents, or tickets. It will also ask about how you use your car, like if it is for commuting to work or just for pleasure. All these bits of information help them build a picture of your risk level, which then affects the price you get, you see.

You might also get asked about different coverage options. This is where you can choose how much protection you want, like liability limits, comprehensive, and collision coverage. They usually give you some common choices, but you can often adjust them to fit what you are looking for. It is kind of like choosing different features for something you are buying, you know?

The online tool is set up so that if you have already put in some information, it remembers it, which is helpful. It is a bit like when you are trying to figure out how many items are in a group, and if you already have a count for some, you just add to that existing number. This makes it quicker if you need to go back or adjust something, pretty much.

After you have put in all the necessary details, the system will show you a price. This is your quote. It will usually break down what is included in that price, so you can see exactly what you are getting for your money. It is a good idea to look over this carefully to make sure it matches what you want, in a way.

Other Ways to get a geico quote

While getting a Geico quote online is super popular, it is not the only way to do it. Some people prefer to talk to a real person, or maybe they just have questions that are easier to ask over the phone. Geico makes it possible to get a quote through a few different methods, so you can pick the one that feels most comfortable for you, you know?

One common way is to call them directly. Geico has a phone number you can dial, and a representative will walk you through the entire process. This can be great if you have a lot of questions, or if your situation is a bit unique. You can ask about different types of coverage, discounts, or anything else that comes to mind, which is helpful, basically.

Another option, though less common for initial quotes, is to visit a local Geico office, if there is one near you. This allows for a face-to-face chat with an agent. Sometimes, seeing someone in person makes the whole thing feel more personal and easier to discuss. It is a bit like trying to find all the different parts of something, like trying to list every file in a folder, even the ones tucked away in subfolders; an agent can help you explore all the options, naturally.

There are also times when you might start a quote online but then decide you want to finish it with a person. Geico usually gives you the option to save your progress and then call them, giving them a reference number. This means you do not have to start all over again, which is nice, really. It is about giving you choices for how you want to get your information, you see.

So, whether you prefer clicking buttons on a screen, chatting on the phone, or even talking to someone in person, Geico tries to make it simple to get your price. It is really about finding the way that works best for you to get the information you need, pretty much. It does not matter which method you pick, as long as you get your quote, that.

What Happens After You Get a Geico Quote?

Once you have gone through the steps and received your Geico quote, you might wonder, "Okay, so what happens now?" Well, getting a quote is just the first step in exploring your insurance options. You are not locked into anything, and you have time to think about it, you know? It is like getting a price tag on something; you can then decide if you want to buy it, basically.

Geico will usually send you an email with your quote details. This is really handy because you can go back and look at it whenever you want. It will show you the coverage levels, the price, and often a quote number you can use if you decide to move forward or if you have more questions. It is important to hold onto this, as a matter of fact.

You then have the chance to compare this quote with other insurance prices you might have received. This is a very, very important step in making a smart choice about your insurance. You want to make sure you are getting the right coverage for your needs at a price that fits your budget, you see. It is about making an informed decision, typically.

If you decide that the Geico quote looks good and you want to go with them, you can usually buy the policy right there online, or you can call them back. They will then ask for your payment information and confirm a few more details to get your policy started. It is a pretty smooth process once you have made your choice, in a way.

Sometimes, people hit a little snag, like getting a message that something could not be found, or a piece of information seems off. If that happens, it is usually a good idea to just call Geico directly. Their team can help sort out any issues and make sure you get the correct quote or policy set up, you know? It is like troubleshooting a small problem; a quick check can often fix it, pretty much.

Remember, getting a quote does not mean you have to buy. It is simply a way to get information and see what your choices are. You have the freedom to decide what is best for you and your situation, so.

Are There Ways to Save Money on a Geico Quote?

When you are looking to get a Geico quote, a lot of people are also thinking about how they can possibly save some money. It is a natural thing to want to get the best deal, right? And the good news is, there are often ways to lower your insurance costs, sometimes without even giving up much coverage, you know?

One of the biggest ways to save is through discounts. Geico, like many insurance companies, offers a whole bunch of them. These can be for things like having a good driving record, taking a defensive driving course, or having certain safety features in your car. It is worth asking about all the different ones you might qualify for, as a matter of fact.

You might also get a discount for bundling your policies. If you get your car insurance and your home or renters insurance from Geico, they often give you a price break for having more than one policy with them. It is a simple way to get a bit of a deal, basically.

Adjusting your deductibles can also affect your price. Your deductible is the amount of money you pay out of pocket before your insurance kicks in if you have a claim. If you choose a higher deductible, your monthly or yearly premium usually goes down. Just make sure you are comfortable paying that higher amount if something happens, you see.

The type of car you drive can also play a big part. Some cars are more expensive to insure because they are more likely to be stolen, or they cost more to repair. If you are in the market for a new car, checking insurance costs beforehand can actually save you money in the long run, pretty much.

It is a bit like trying to find all the groups a person is a part of; you want to make sure you are getting credit for every single thing that could save you money. Geico’s system will often automatically apply some discounts, but it never hurts to double-check or ask if there are others you might be missing, you know?

Common Hiccups When You try to get a geico quote

Even though getting a Geico quote is usually a pretty smooth process, sometimes you might run into a small problem or two. It is totally normal, and most of these little hiccups are easy to sort out, you know? It is kind of like when you are trying to get a computer command to work just right, and it gives you an error message; you just need to figure out what went wrong, basically.

One common thing is accidentally putting in wrong information. Maybe you typed a number wrong in your VIN, or you put in the wrong birth date. The system might then tell you it cannot find your car, or it might give you an unexpected price. If this happens, just go back and double-check all the details you entered, as a matter of fact.

Sometimes, the system might not recognize your address or a specific type of car. This is less common, but it can happen. If you find yourself stuck, and the online tool just is not letting you move forward, the best thing to do is to call Geico directly. They have people who can help you put in the information correctly and get your quote, you see.

Another thing that can happen is not having all the necessary information ready. If you start the quote and then realize you do not know your car's mileage or the full name of another driver, you might have to stop and find that info. That is why it is helpful to gather everything beforehand, pretty much.

You might also get a quote that seems much higher or lower than you expected. If it is much higher, it could be because of something in your driving history, or maybe you selected a very high level of coverage. If it is much lower, you might want to double-check the coverage levels to make sure they are what you want. It is always good to review the details carefully, you know?

It is like trying to get the row count of a big table of data; sometimes, you just need to make sure all the entries are correct for the count to be accurate. These small issues are usually quick fixes, and Geico’s support is there to help if you get stuck, in a way.

Can I Change My Mind After I get a geico quote?

A very common question people have is, "Can I change my mind after I get a Geico quote?" And the simple answer is, yes, absolutely. Getting a quote is not a commitment to buy anything at all, you know? It is simply an estimate, a price they are offering you for a specific set of coverages, as a matter of fact.

You are free to get a quote, look it over, compare it with other companies, and then decide what you want to do. There is no pressure to buy right away, and Geico understands that people need time to make important decisions about their insurance. It is like trying out a new program; you can install it, see if it works for you, and if not, you can just remove it, basically.

The quote you receive will usually be valid for a certain period, often 30 days or so. This gives you plenty of time to think about it without the price changing. If you decide to come back later and buy the policy, you can usually just use the quote number you were given to pick up where you left off, you see.

If you do not buy the policy, nothing happens. You will not be charged anything, and Geico will not keep bothering you endlessly. They might send a follow-up email or two, but that is usually it. It is a no-obligation way to check out your options, pretty much.

So, feel free to get a Geico quote whenever you are curious or need to compare prices. It is a tool for you to use to gather information, and you are always in control of whether you move forward or not, you know? It is all about giving you the freedom to make the best choice for your own situation, in a way.

- Did Mike Wolfe Die

- Are The American Pickers Still Alive A Deep Dive Into Their Journey

- Clara Almnzar A Comprehensive Overview Of Her Life And Career

- 5movierulz Alternative Discover The Best Streaming Sites For Movies And Tv Shows

- Mamitha Baijus Father A Deep Dive Into His Life And Influence

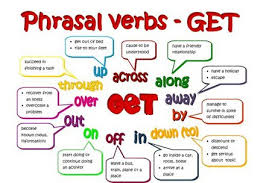

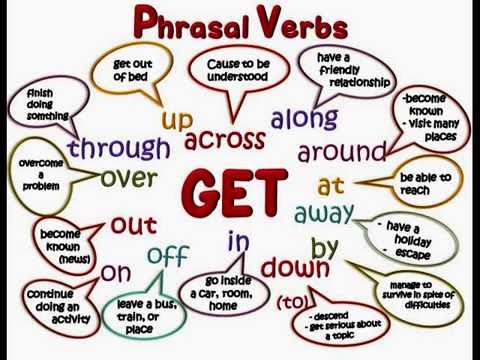

Use of GET : How to Use 'GET' in English Grammar | Spoken English

About the verb GET and its different meanings - The crazy teacher's

How to Use GET Correctly - Most Common Uses of the Verb GET